Training Courses

Advanced Tooling

Statistical Arbitrage

Financial Data

Arbitrage Code

Tools and Techniques for Retail Quants and Traders...powered by wizardry

”...first of all i want to thank you, for the amazing platform. I joined yesterday after finding you on youtube. I would consider myself a seasoned pairs trader but in fact I was only focussing on correlation for a long period of time. Since a few month now I incorporate cointegration in my trading. Your tools help me a lot not to spend too much time copy and pasting data in my excel files.“

Looking for your edge?

Start here.

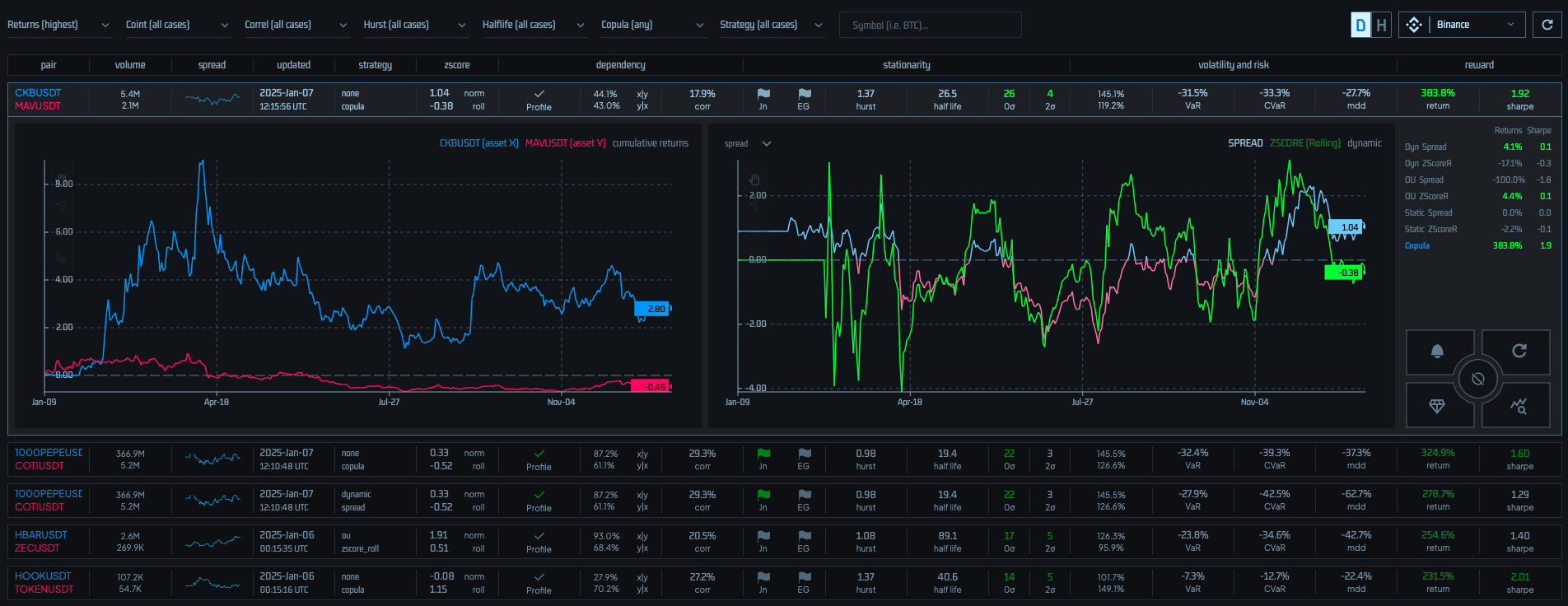

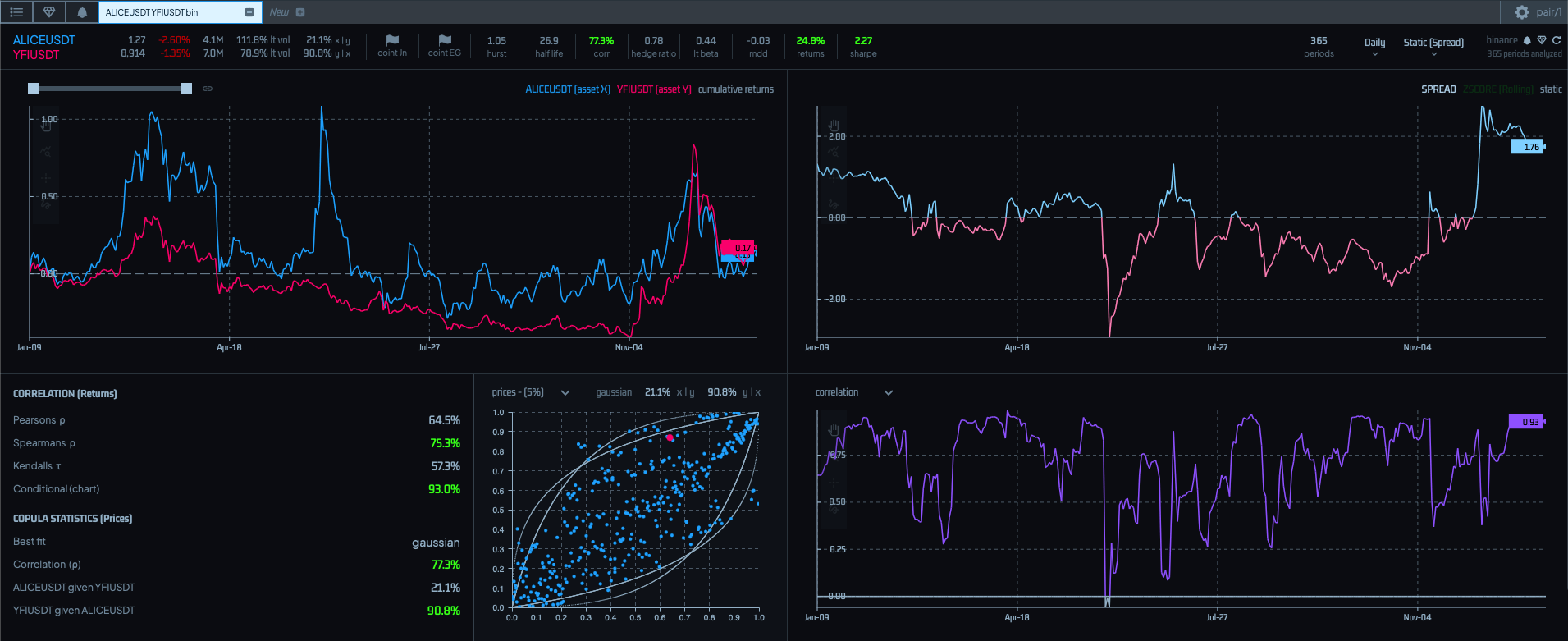

Discover cointegrated and correlated cryptocurrencies, forex and stocks which exhibit incredible backtest results. Simulate trading them and get alerted when an indicator fires.

”Im impressed by your arbitrage scanner and all the things about it.“

Discover your edge

An Objective Approach

Cryptocurrency markets are notorious for their volatility and unpredictability, often leading investors to make decisions based on speculation rather than solid analysis. However, a more reliable and potentially profitable approach is to use statistical arbitrage techniques, leveraging concepts like cointegration, correlation, and backtesting.

Cointegration is a statistical property where two or more time series, like cryptocurrency prices, move together in the long term, even if they may appear to diverge in the short term. This phenomenon is crucial in identifying pairs of cryptocurrencies whose prices are historically bound together. When these pairs deviate from their typical relationship, it creates an opportunity for statistical arbitrage. By taking opposing positions in these cointegrated pairs—buying the undervalued asset and selling the overvalued one—investors can profit when the prices realign.

Correlation, on the other hand, measures the degree to which two assets move in relation to each other. In cryptocurrency markets, where price movements can be abrupt and dramatic, understanding correlations can help in diversifying portfolios and reducing risk. Assets with low or negative correlations can be paired to create a balanced portfolio that can withstand market turbulence.

Backtesting is a critical component of any trading strategy. It involves testing a strategy on historical data to assess its viability and potential profitability. In the context of statistical arbitrage, backtesting helps in fine-tuning parameters, identifying optimal entry and exit points, and understanding the strategy's risk-reward profile.

”Thank you, thank you, thank you. Is there a way you can train me in mastering this tool? The value is priceless beyond words, and I am willing to travel to the UK to learn, if necessary.“

Simulated trading

Track performance

Discover the cutting-edge in crypto trading with our Statistical Arbitrage Simulated Trade Tracking Tool. Experience the thrill of trading without any risk. Our tool allows you to execute pretend trades in real-time, tracking the performance of various crypto assets with precision. This innovative platform is perfect for both beginners and seasoned traders looking to sharpen their strategies and understand market dynamics without financial exposure.

Our intuitive interface makes it easy to navigate through the complexities of cryptocurrency markets. Analyze trends, experiment with various trading scenarios, and gain valuable insights into asset performance. The tool's sophisticated algorithms simulate market conditions, providing a realistic trading experience.

”I have signed onto the website and I cannot tell you how thoroughly impressed I am with this tool..... This is excellent and so much easier to use than any of the other software that is out there... Especially the smart contract section. Its amazing!“